|

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR (%) |

|---|---|---|---|---|---|---|

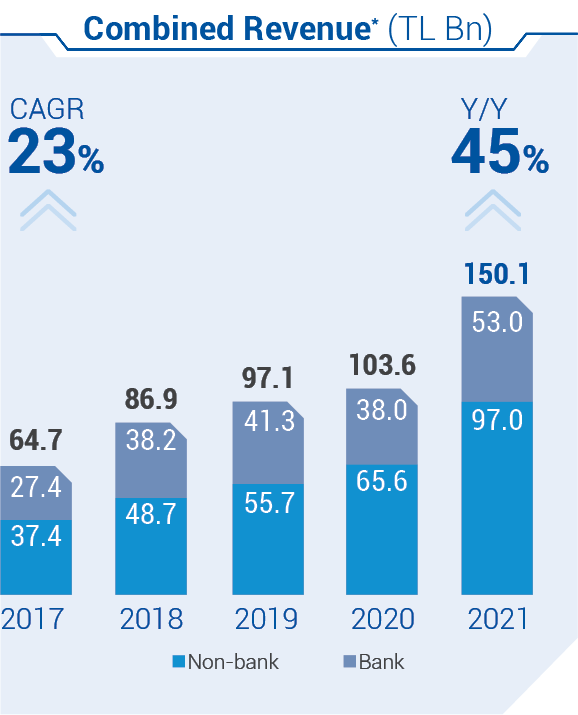

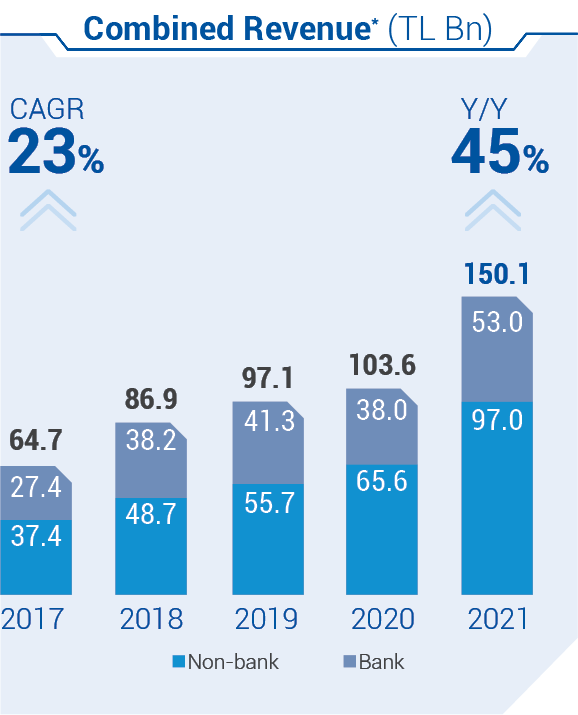

Combined Revenue |

65.6 |

88.1 |

97.6 |

104.0 |

151.6 |

23.3 |

Combined Revenue* |

64.7 |

86.9 |

97.1 |

103.6 |

150.1 |

23.4 |

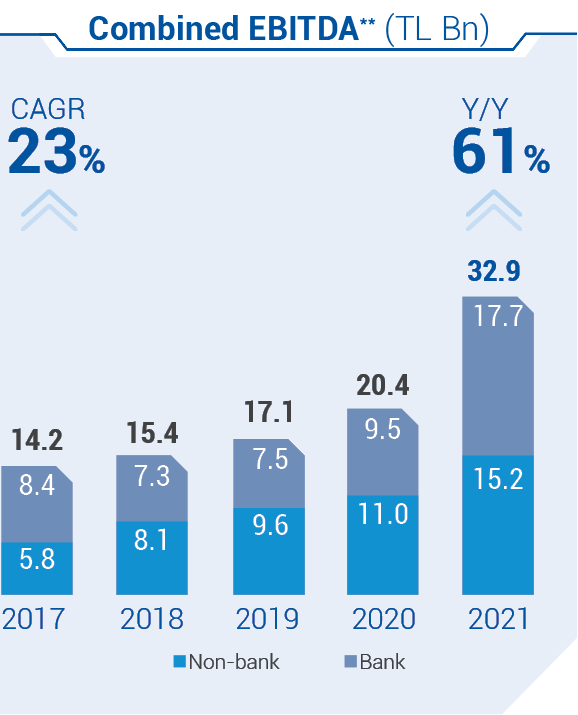

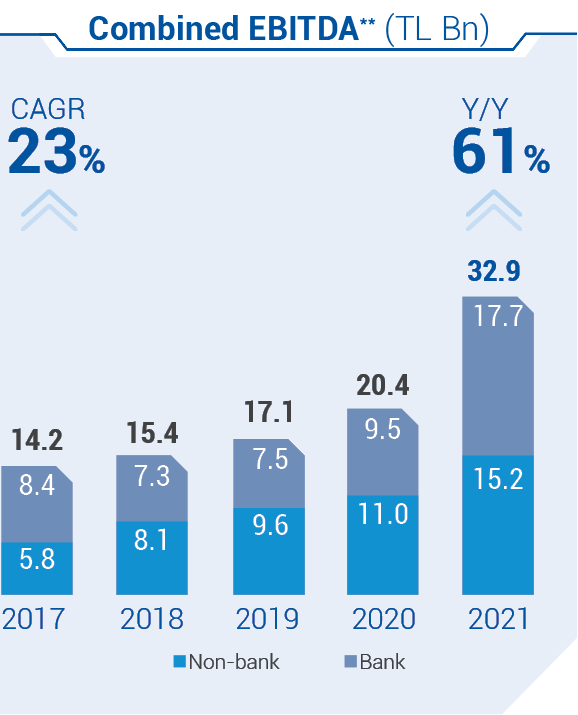

Combined EBITDA** |

14.2 |

15.4 |

17.1 |

20.4 |

32.9 |

23.4 |

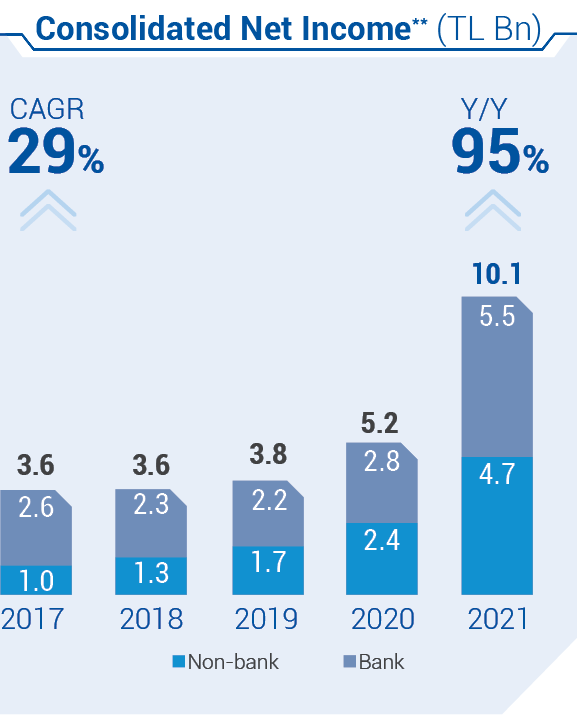

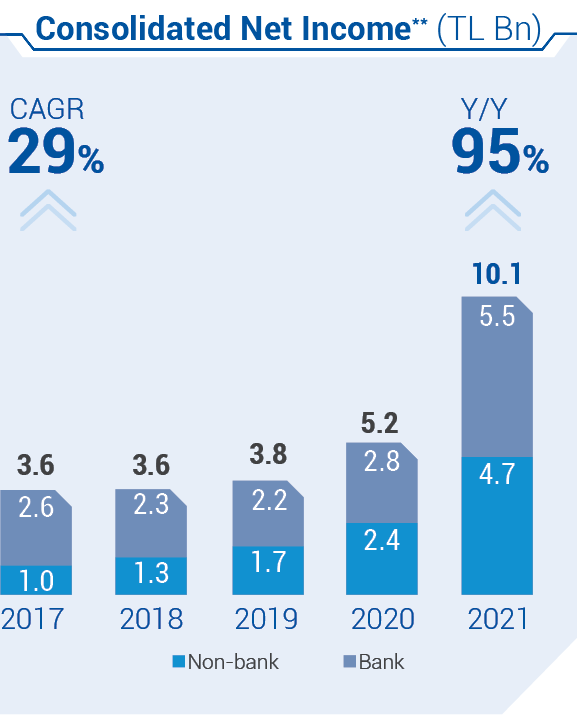

Consolidated Net Income (Share of Parent Company) |

3.5 |

3.8 |

3.8 |

4.8 |

12.0 |

36.1 |

Consolidated Net Income** (Share of Parent Company) |

3.6 |

3.6 |

3.8 |

5.2 |

10.1 |

29.4 |

Combined Operational Cash Flow *** |

4.6 |

5.6 |

9.5 |

10.8 |

12.4 |

28.1 |

Holding Solo Net Cash |

1.7 |

2.6 |

1.7 |

1.1 |

2.5 |

10.1 |

Combined Net Financial Debt/EBITDA**** |

3.1x |

2.3x |

2.2x |

1.5 x |

1.2x |

|