Our Strategic Direction

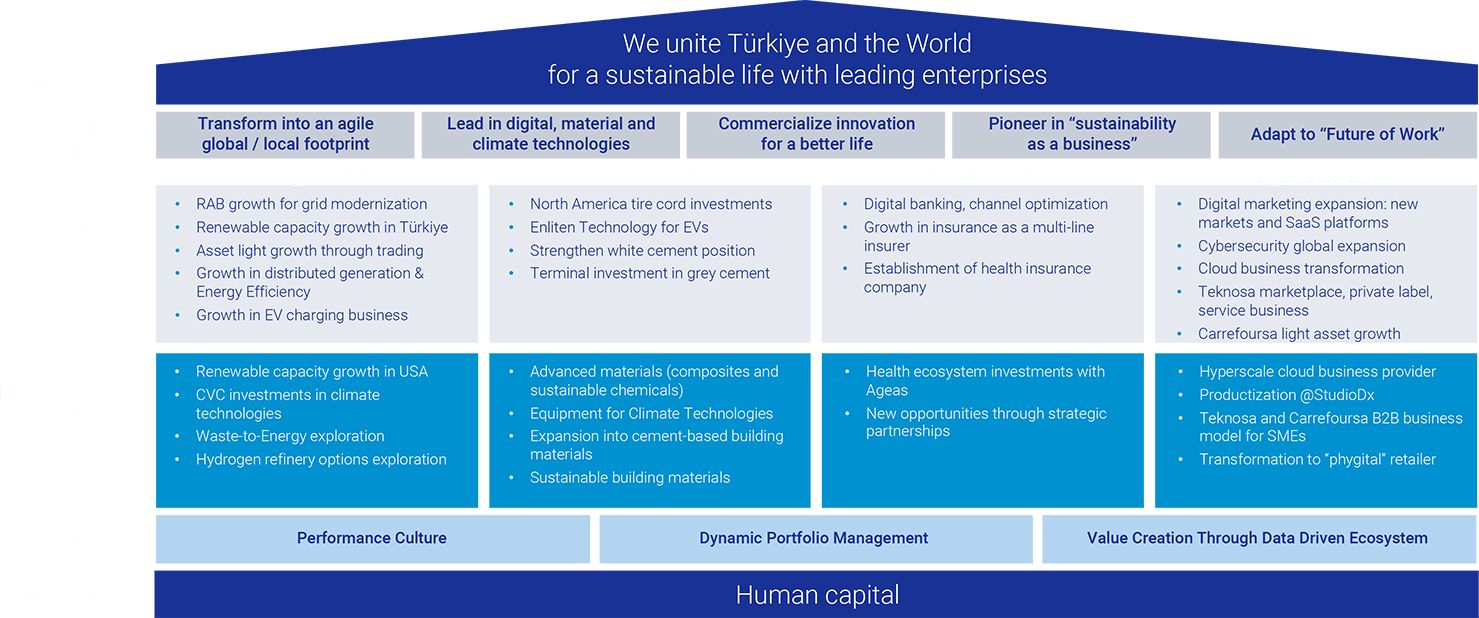

Sabancı Group reinforces its role as a global player with its contribution for a sustainable future and creates enduring value for its stakeholders and Turkish economy.

By combining its solid financial structure, dynamic portfolio management and robust sense of corporate governance with its innovation and technology oriented business approach, Sabancı Group is not only delivering a strong growth from its core businesses but also gaining significant opportunities in new growth platforms.

Acknowledging sustainability as fundamental principle, and setting strong growth and stakeholders returns as key drivers in its investment decisions, Sabancı Group unites Türkiye and the World for a sustainable life with leading enterprises.

Rising from a foundation of global experience, high performance culture and value focused ecosystem built in the course of 97 years, Sabancı Group advances towards its second century with a high confidence and enhanced strategic focus to accelerate its growth and transformation.

Sabancı at 2022

to ‘new economy’

Financial Performance

future

From the new normal,

to 'new economy'

Technology has lent substantial impetus to change across the globe. Amid this change, the pandemic and global gyrations brought to the fore a major concept, namely the ‘new normal’.

In the aftermath of the pandemic, we, as Sabancı Group, tended not to adapt ourselves to the new normal, rather positioned ourselves as one its play-makers.

As a part of its commitment to dynamic portfolio management strategy, Sabancı Group has successfully executed its transformation process in 2022 by completing investments in various businesses. After divesting its shares in Phillip Morris by the beginning of the year and raising TL 3.2 billion in proceeds, Sabancı Group allocated TL 4.9 billion throughout 2022 specifically to energy and climate technologies, advanced material technologies and digital technologies, which are defined as ‘new economy’ investments by the Group.

Strong Financial

Performance

Consolidated net income growth higher than combined revenue and EBITDA leads to a historically high ROE despite faster pace in investments.

* Excludes non-operational and non-recurring one-off items and IFRS16 impact in retail

** Excludes non-operational and non-recurring one-off items

Sustainable future

By acknowledging sustainability as fundamental principle of our investment decisions, we achieve strong results. Our ESG performance and efforts at this front are recognized by global ESG indices and ratings.

* Twice in a row.

** Diversified Financials Category

*** Investment Holding Companies