Financial Services - 2022 General Overview

In 2022, Sabancı Holding strengthened its successful cooperation with Ageas Group by establishing a new health insurance entity – Sabancı Ageas Health Insurance – under Aksigorta. This new company will act as a health competence center serving Sabancı Holding’s financial services companies, Agesa and Aksigorta, which are already working in strategic alignment. Sabancı Ageas Health Insurance will focus on leveraging all distribution channels with a unified customer centric approach and joint working models to transfer experience and create efficiency

In 2022, Sabancı Holding strengthened its successful cooperation with Ageas Group by establishing a new health insurance entity – Sabancı Ageas Health Insurance – under Aksigorta. This new company will act as a health competence center serving Sabancı Holding’s financial services companies, Agesa and Aksigorta, which are already working in strategic alignment. Sabancı Ageas Health Insurance will focus on leveraging all distribution channels with a unified customer centric approach and joint working models to transfer experience and create efficiency

Agesa, Sabancı Holding’s pension and life business, exited fiscal year 2022 as the leader of both the pension and life sectors thanks to its sophisticated customer experience supported by a focused sales team. The company maintained its leadership in assets under management (AUM) in the pension market with TL 75.6 billion AUM. In addition, Agesa became the highest premium-generating private insurance provider in the total life and personal accident market. In 2022, the company’s total life and personal accident premium production jumped by 84% year-on-year to TL 3.7 billion with an 11.6% market share.

In addition to its market share leadership, Agesa remains an industry pioneer by offering the most innovative products and making a difference with its exceptional services and customer experience. As a result, Agesa’s IFRS net profit doubled compared to the prior year, climbed to TL 1.1 billion in 2022.

Aksigorta, Sabancı Holding’s non-life insurance provider, retained its strong fifth place market position in 2022. During the year, the company posted gross written premiums (GWP) of TL 13.6 billion – up a record high 94% year-on-year. Effectively using multiasset management to achieve the best performance, Aksigorta reported TL 7.6 billion TL AUM at end-December 2022.

Protect and Grow the Core

With the aim of protecting and growing the core business, Sabancı Holding financial services companies focus on extending their coverage and growing while boosting efficiency in their current distribution channels across the country.

The companies serve 6+ million customers through an extensive distribution network comprised of a bank assurance network established with Akbank, the industry’s largest direct sales team, agencies, brokers and digital channels.

While providing all inclusive support to its affiliated agencies, Sabancı Holding financial services companies expanded their agency distribution network substantially, recording over 50% growth in five years. Today, Sabancı Holding financial services companies have nearly 4,000 affiliated agencies – about 20% of the total agency network in Türkiye in 2022.

In the life and pension business, Agesa focused on expanding its direct sales channel this year. Boasting the most experienced sales team in the industry, the company ramped up its direct sales force from 365 agents in 2019 to 600 in 2022 to bring life and pension insurance solutions to more people.

Addressing the savings and investment needs of individuals, Agesa offers a wide range of diversified funds and fund consultancy services within its private and group pension plans.

To enrich savings alternatives and expand the market, the company developed an innovative savings product “Hayata Yatırım Sigortası” which accelerated new policy production in the savings market.

In the non-life business, Aksigorta stepped up its new product development efforts in 2022. New offerings introduced included complementary health coverage, critical illness and surgical cash at Akbank, electric mini vehicle casco, 4x4 business package, pet health insurance, and eco casco.

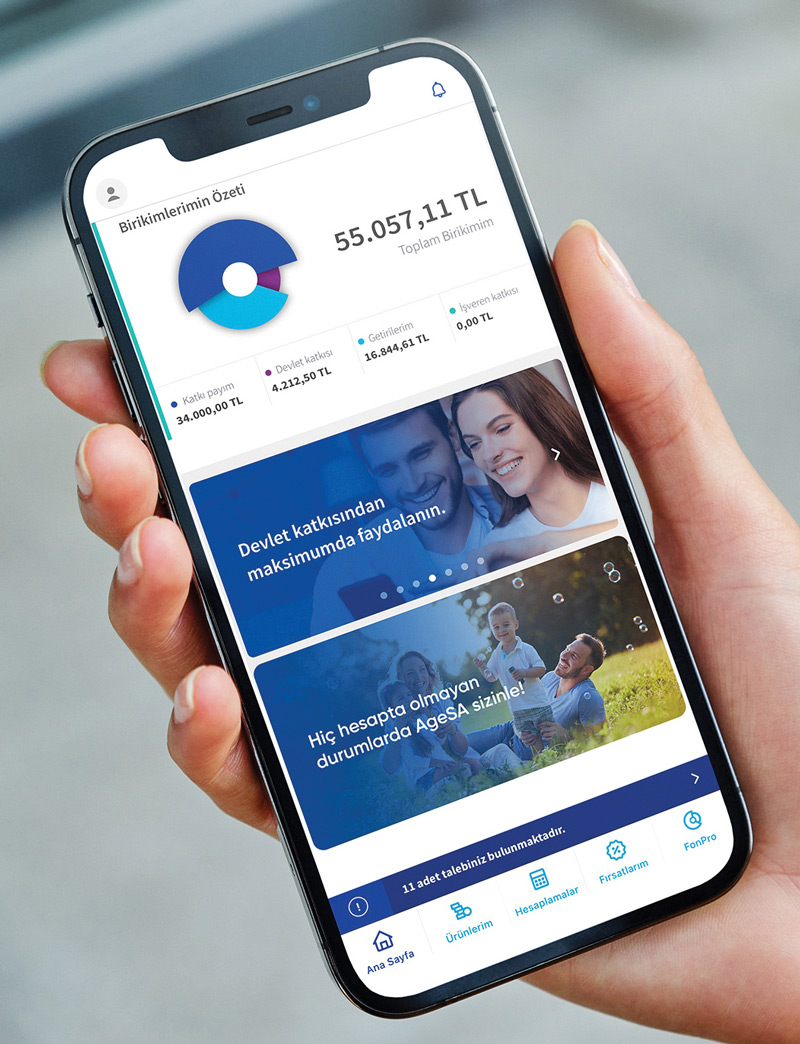

In the life and pension business, Agesa continuously invests in digitization and analytics to deepen existing customer relationships and grow the customer base. In addition to new processes on the online sales platform, biometric signature and automated fund management advisory services, Agesa Mobile offers diversified valueadded customer services. The popular application proved its success by winning international awards for its excellence and garnering high customer satisfaction scores.

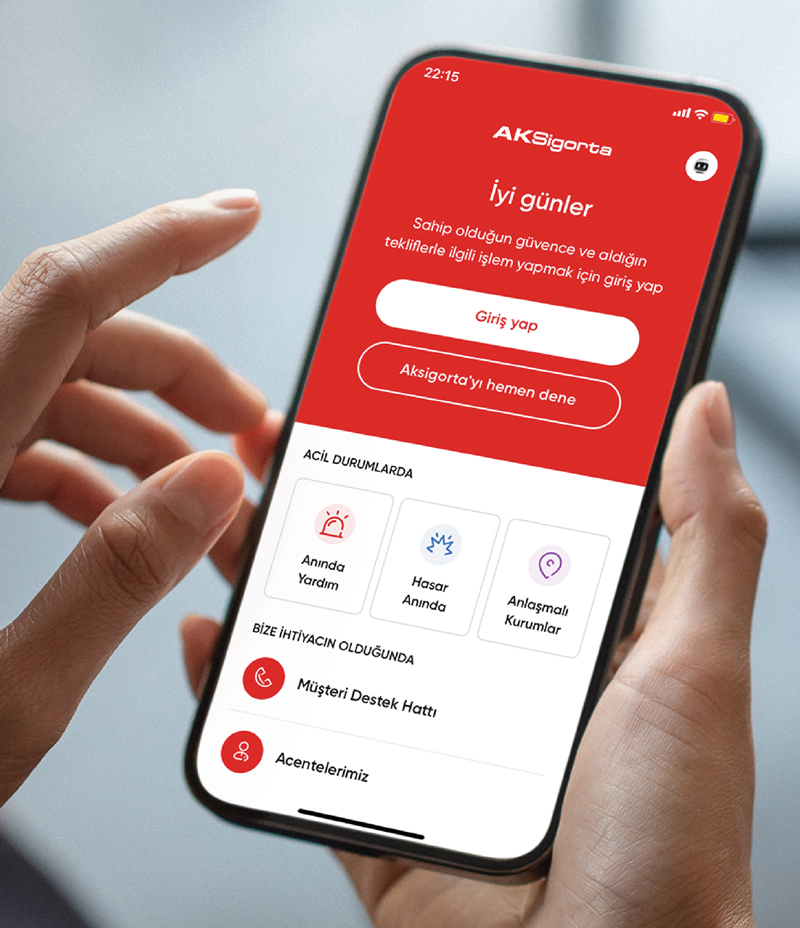

In the non-life business, Aksigorta Mobile was launched in the last quarter of 2021 to serve as a single digital contact point for customers’ comprehensive risk management needs. To date, about 350,000 persons have downloaded the app with some 70,000 active users every month. The Aksigorta Mobile app has a solid application store rating of 4.0. Besides its insurance policy management features, the app includes other value-added functionality such as virtual risk assistant. A marketplace is planned for launch in the coming months.

In 2022, Sabancı Holding financial services companies entered a new collaboration with BlindLook to launch a voice guidance feature for disabled users in their digital channels. With this feature, the companies are able to offer their customers an inclusive and barrier-free digital insurance experience.

In the non-life business, Aksigorta utilizes analytics to develop advanced pricing algorithms such as GLM. AIbased pricing models effectively assess risks via smart scoring applications by incorporating various risks from multiple data sources into a single score. This approach improves technical margins and automates underwriting processes while facilitating active sales management across a wide agency network.

Aksigorta Digital Assistant (ADA) facilitates nearly 4 million transactions each year across 150 different processes, both customer-facing such as price quotations and chat bot, and back-end operations like claims process automation. Thanks to ADA, Aksigorta outperforms the market in terms of efficiency. In Q2 2022, the company reported G&A (General and administrative expenses) / GWP of 3.6% vs a market average of 5.9%. This year, ADA started serving Akbank Relationship Managers for their insurance related inquiries. Digital mirror technology provided by ADA also facilitates the monitoring of core business processes on virtual platforms, resulting in digitized and rapid automated processing of key tasks.

In the life and pension business, data and analytics are effectively used for designing customer management models that recommend the most appropriate products and services for an individual’s needs with personalized communications. Based on customer segmentation, Agesa builds smart models to boost value for both customers and the company via AI and advanced analytics solutions.

Invest in New Growth Platforms

In line with its strategy to grow in new platforms, Sabancı Group established a new health insurance firm in August 2022 under Aksigorta. This new entity was founded to serve as a health competence center for the Group’s financial services companies and expand the insurance business towards a holistic healthcare ecosystem.

Digital bank assurance is gaining importance with more customers preferring digital channels for their banking transactions. In response to this growing trend, Sabancı Holding financial services companies ramped up their digitalization efforts and penetration in Akbank’s sales channels.

Product offerings on Akbank Mobile were enhanced with card protection and password protection features. Customer experience was improved and the Insurance Menu was introduced on the app.

With convenient end-to-end-digital processes, customers can obtain credit life insurance seamlessly while applying for a loan product from Akbank Mobile or Akbank Customer Contact Center. In addition, customers can finalize their pension policy applications via Akbank Mobile.

The non-life business closely cooperated with third-party digital platforms, especially in the payment services, telco and e-commerce sectors. In 2022, Aksigorta initiated a new partnership with leading automobile brand where EV casco is offered, in line with Sabancı Group’s sustainability strategy, in addition to ongoing partnerships with leading companies in their sector.

The Way Forward

Sabancı Holding financial services companies aim to maintain their strong presence in all current business lines while further expanding the life and nonlife insurance business to new growth platforms.

To this end, Agesa plans to enrich its product range and services with innovative, customer-oriented solutions. Meanwhile, Aksigorta will focus on sustaining its profitable growth with a balanced portfolio and strengthened balance sheet as well as with a bestin-class customer and stakeholder experience.

Digitalization and advanced technology are having a major impact on the insurance business. As a result, Sabancı Group financial services companies plan to invest further in new and transformative technologies.

To respond to the shift of banking to mobile, the Group’s financial services companies’ strategic priorities include digitizing bank assurance, penetrating bank customers via digital channels and capitalizing on advanced analytics.

In addition to growing the core business, Sabancı Group financial services companies aim to pursue new business model opportunities arising from emerging business dynamics. Today, customers increasingly expect businesses to create experiences on platforms they use, such as bank, fintech and e-commerce sites. As a result, embedded insurance is another focus area for Sabancı Holding’s financial services companies in the coming years.

Health insurance synergies & providing new solutions

Greater awareness of health and wellbeing, an ageing society and higher healthcare expenditures are key growth drivers in the sprawling health ecosystem. Sabancı Group’s main objective is to develop a new healthcare business focused on health insurance and adjacent opportunities in the broader health ecosystem. Rather than simply providing financial support for health needs via insurance, Sabancı Group financial services companies aim to develop a 360º approach to health and wellbeing, with both physical and digital products and services that facilitate faster, better and more personalized healthcare solutions.