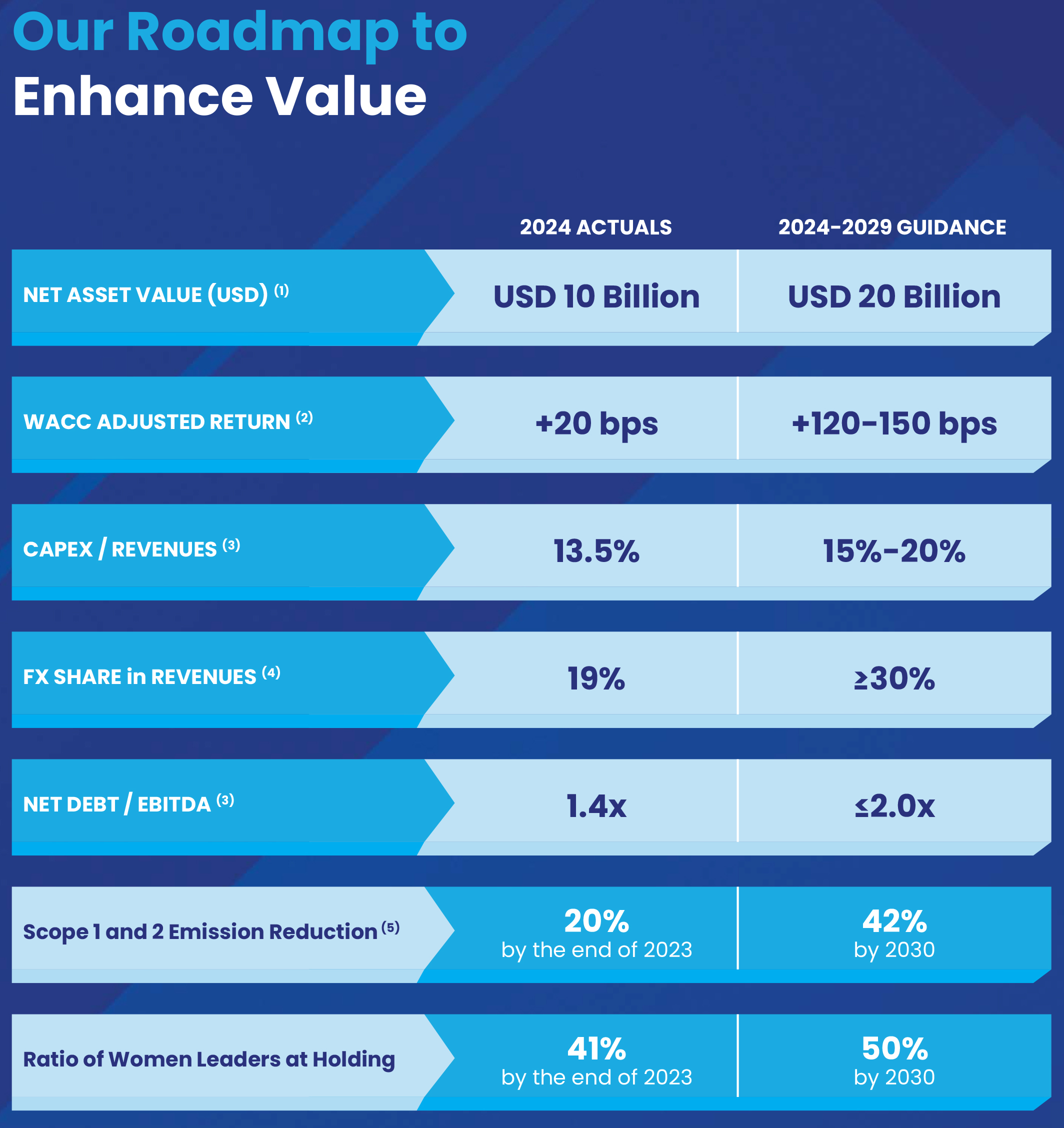

Our Roadmap To Enhance Value

(1) End of guidance period, excluding cash

(2) Average of guidance period, WACC adjusted return for 2018-2023 is at 12.43%, for 2024-2029 WACC assumed at 12%

(3) Non-bank, combined, on average of guidance period (4) Non-bank, combined, at the end of the guidance period (5) 2021 Baseline